Accounting vs. Finance: Understanding the Core Differences

Account vs. Finance: understand the core differences

The fields of accounting and finance, while intimately relate and oftentimes confused, serve distinct purposes within the business ecosystem. Both disciplines deal with money and financial information, but they approach it from basically different perspectives. Understand these differences is crucial for students choose career paths, professionals consider specialization, and business owners make strategic decisions about their company’s financial management.

Core focus and purpose

The about fundamental difference between accounting and finance lies in their primary focus and purpose within an organization.

Accounting: the language of business

Account principally concern itself with the systematic recording, reporting, and analysis of financial transactions. It’s oftentimes described as th” language of business” because it ttranslatescomplex financial activities into standardized, understandable information. The core purpose of accounting is to:

- Track and record all financial transactions

- Ensure compliance with regulatory requirements

- Prepare financial statements (income statements, balance sheets, cash flow statements )

- Maintain accurate historical financial records

- Report on the financial health and performance of an organization

Accounting is principally backwards look, focus on what has already happened financially within a company. Iprovidesde the factual foundation upon which financial decisions can be make.

Finance: the forward-looking discipline

Finance, in contrast, use account information as a starting point but focus on plan for the future. Finance is concern with:

- Optimal allocation of financial resources

- Investment decision make

- Capital raise strategies

- Risk management

- Maximize shareholder value

- Financial forecasting and planning

Finance is inherently forward moving look, use historical data to make predictions and strategic decisions about future financial activities. It answers questions lik” where should we invest our money? ” And” how should we fund our growth? ”

Time orientation

The time orientation of these disciplines represent another significant difference:

Accounting’s historical perspective

Accounting deals mainly with what has already occurred. It meticulousdocumentsent past transactions and create reports that reflect historical performance. This historical fomakesmake account the reliable record keeper of an organization’s financial story. Accountants” k: ” what happen with our finances? ”

Finance’s future orientation

Finance use historical accounting data but focus on the future. Financial professionals analyze trends, forecast outcomes, and make recommendations base on projections. They’re concerned with growth, investment returns, and strategic financial planning. Finance professionals ask:” what could happen with our finances, and how can we optimize outcomes? ”

Skill sets and methodologies

The different purposes of accounting and finance course require different skill sets and methodologies:

Accounting skills and methods

Accounting demands precision, attention to detail, and methodical work. Key skills and methodologies include:

- Bookkeeping and record keeping

- Knowledge of accounting standards (gGAAP iIFRS)

- Preparation of financial statements

- Tax compliance

- Auditing procedures

- Internal controls implementation

Accountants typically follow establish procedures and standards, with a focus on accuracy and compliance. The work oftentimes involves specific rules and regulations that must befollowedw incisively.

Finance skills and methods

Finance require analytical thinking, strategic vision, and comfort with uncertainty. Key skills and methodologies include:

- Financial analysis and modeling

- Risk assessment and management

- Investment analysis

- Capital budgeting

- Portfolio management

- Valuation techniques

Finance professionals oftentimes work with probabilities, scenarios, and forecasts. They must be comfortable to make recommendations base on incomplete information and change market conditions.

Decision make role

The role each discipline play in organizational decision make air illustrate their differences:

Accounting’s informational role

Accounting provide the factual basis for decision-making. It answers questions like:

- How profitable was the company last quarter?

- Are we meet our budget targets?

- What are our current assets and liabilities?

- Are we tax compliant?

Accounting information is crucial for operational decisions and compliance, but it typically doesn’t now address strategic questions about future investments or growth opportunities.

Finance’s strategic role

Finance play a more direct role in strategic decision-making. It helps answer questions like:

- Should we expand into a new market?

- Is this acquisition financially viable?

- What’s the optimal capital structure for our company?

- How should we allocate resources between different business units?

Finance professionals frequently have a seat at the table when major strategic decisions are being make, use their analytical insights to guide the organization’s future direction.

Regulatory framework

The regulatory environments for accounting and finance to differ importantly:

Accounting’s strict regulatory framework

Accounting operate within an extremely regulate environment with establish standards and principles:

- Broadly accepted accounting principles (gGAAP)

- International financial reporting standards (iIFRS)

- Carbines Oxley act requirements

- Tax laws and regulations

- Auditing standards

These regulations ensure consistency, transparency, and reliability in financial reporting. Accountants must adhere to these standards, with limited room for interpretation or deviation.

Finance’s more flexible framework

While stock still subject to regulations (peculiarly in areas like banking, investments, and securities ) finance broadly operate with more flexibility:

- Financial models can be customized to specific situations

- Investment strategies can vary wide base on risk tolerance and goals

- Capital allocation decisions involve judgment and strategic considerations

- Financial forecasting allow for different scenarios and assumptions

This flexibility allows finance professionals to adapt their approaches to change market conditions and organizational needs.

Career paths and specializations

The career trajectories in accounting and finance reflect their different focuses and requirements:

Accounting career paths

Common accounting career paths include:

- Public accounting: work for accounting firms that provide services to clients

- Corporate accounting: work within a company’s accounting department

- Tax accounting: specialize in tax preparation and compliance

- Audit: examine financial records for accuracy and compliance

- Forensic accounting: investigate financial discrepancies and fraud

- Government accounting: work for public sector organizations

Professional certifications like certified public accountant (cCPA) certified management accountant ( (aCMA)nd chartered accountant ( ca( ar)extremely value in accounting careers.

Finance career paths

Finance offer diverse career options include:

- Corporate finance: manage a company’s financial activities

- Investment banking: help companies raise capital and execute mergers

- Financial analysis: evaluate investment opportunities and business performance

- Portfolio management: manage investment portfolios for clients

- Risk management: identify and mitigate financial risks

- Financial planning: help individuals or organizations plan for financial goals

Relevant certifications include chartered financial analyst (cCFA) financial risk manager ( (mFRM)nd certified financial planner ( cf()CFP)

Organizational structure

Within organizations, accounting and finance typically occupy different positions in the hierarchy:

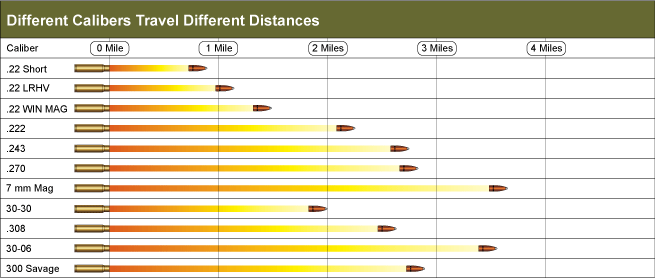

Source: desklib.com

Accounting department structure

The accounting department normally reports to the chief financial officer( CFO) and include roles such as:

- Controller or chief accounting officer

- Accounting managers

- Staff accountants

- Bookkeepers

- Accounts payable / receivable specialists

- Tax accountants

This department focus on maintain accurate financial records, ensure compliance, and produce financial reports.

Finance department structure

The finance department besides typically report to the CFO but include different roles:

- Treasurer

- Financial analysts

- Investment managers

- Financial planners

- Risk managers

- Credit analysts

This department focus on financial strategy, capital allocation, and optimize the company’s financial performance.

How accounting and finance work unitedly

Despite their differences, accounting and finance are extremely interdependent and work unitedly to support organizational success:

The information flow

Accounting provide the critical financial data that finance need for analysis and decision-making. Without accurate accounting information, finance professionals couldn’t efficaciously:

- Analyze financial performance

- Create reliable forecasts

- Make informed investment recommendations

- Develop realistic budgets

This information flow represents the fundamental relationship between the two disciplines.

Collaborative decision-making

In intimately function organizations, accounting and finance professionals collaborate on key initiatives:

- Budgeting processes

- Financial reporting and analysis

- Strategic planning

- Risk management

- Compliance efforts

This collaboration leverage the strengths of both disciplines: accounting’s precision and attention to detail combine with finance’s strategic vision and analytical capabilities.

Education and background

The educational pathways for accounting and finance reflect their different focuses:

Accounting education

Accounting education typically emphasizes:

- Financial accounting principles

- Taxation

- Audit

- Accounting information systems

- Business law

- Ethics in account

Many accounting programs are specifically design to prepare students for professional certifications like the CPA exam.

Finance education

Finance education frequently focus on:

- Financial markets and institutions

- Investment analysis

- Corporate finance

- Financial modeling

- Risk management

- International finance

Finance programs typically include more economics, statistics, and quantitative analysis than accounting programs.

Conclusion: complementary but distinct disciplines

Accounting and finance represent complementary but distinct approaches to manage an organization’s financial activities. Accounting provide the crucial foundation of accurate financial information, while finance leverages that information to make strategic decisions about the future.

Understand these differences help organizations structure their financial functions efficaciously and enable individuals to choose career paths that align with their interests and strengths. While accounting appeals to those who value precision, consistency, and clear guidelines, finance attract those who enjoy analysis, strategy, and work with uncertainty.

In the virtually successful organizations, accounting and finance work hand in hand, combine their different perspectives and strengths to support sound financial management and strategic decision-making. This partnership between the past focus record keepers and the future orient strategists create a comprehensive approach to financial management that drive organizational success.

Source: ahmerwrites.com

MORE FROM nicoupon.com