AOP in Finance: Understanding Annual Operating Plans and Other Financial Acronyms

Understand AOP in finance

In the world of finance and business planning, acronyms abound. One common acronym you might encounter is AOP. The primary meaning of AOP in finance is” annual operating plan. ” This comprehensive document serve as a roadmap for a company’s operations and financial expectations for the upcoming fiscal year.

Nevertheless, like many acronyms in finance, AOP can have multiple meanings depend on the context. Let’s explore the various definitions and applications of AOP in the financial sector.

What does AOP stand for in finance?

Annual operating plan (most common definition )

The well-nigh prevalent meaning of AOP in finance is annual operating plan. This is a detailed document that outline a company’s operational and financial goals for the come year. It typically includes:

- Revenue targets

- Expense budgets

- Profit projections

- Capital expenditure plans

- Headcount planning

- Key performance indicators (kKPIs)

- Strategic initiatives and projects

An annual operating plan bridges the gap between a company’s long term strategic plan and its day to day operations. While strategic plans might cover 3 5 years, theAOPp focus specifically on the next 12 months with often greater detail.

Alternative meanings of AOP in finance

While annual operating plan is the well-nigh common definition, AOP can occasionally refer to:

- Average order price Use in retail and e-commerce financial analysis

- Asset optimization program Relate to manage and maximize returns on company assets

- Account operating procedures Standardized processes for financial record keeping

- Adjusted operating profit A non GAAP financial measure use by some companies

The context in which AOP will appear will typically will clarify which definition will apply. For the remainder of this article, we will focus on the primary meaning: annual operating plan.

The purpose and importance of annual operating plans

An effective AOP serve multiple critical functions within an organization:

Strategic alignment

The AOP translate high level strategic objectives into concrete, actionable plans. It ensures that daily operations and resource allocation decisions support the company’s long term vision and goals. By create this alignment, organizations can maintain focus on their virtually important priorities.

Financial planning and budgeting

Peradventure the virtually visible aspect of an AOP is its financial component. The plan establish revenue targets, expense budgets, and profit expectations for the year. These financial projections become the benchmark against which actual performance is measure.

Detailed budgets within the AOP provide guidance for:

- Departmental spending limits

- Investment priorities

- Hire decisions

- Resource allocation across the organization

Performance measurement

With clear targets establish in the AOP, companies can efficaciously track their progress throughout the year. Regular variance analysis (compare actual results to the plan )helps identify areas that are exexceededxpectations or fall short, allow for timely adjustments.

Risk management

The AOP development process require companies to anticipate potential challenges and build contingency plans. These forwards look assessment help organizations prepare for various scenarios and reduce their vulnerability to unexpected disruptions.

Communication and alignment

The AOP serve as a communication tool that align all stakeholders around common objectives. When decent deploy, it ensures that everyone from the c suite to frontline employees understand the organization’s priorities and their role in achieve them.

Key components of an annual operating plan

A comprehensive AOP typically include the follow elements:

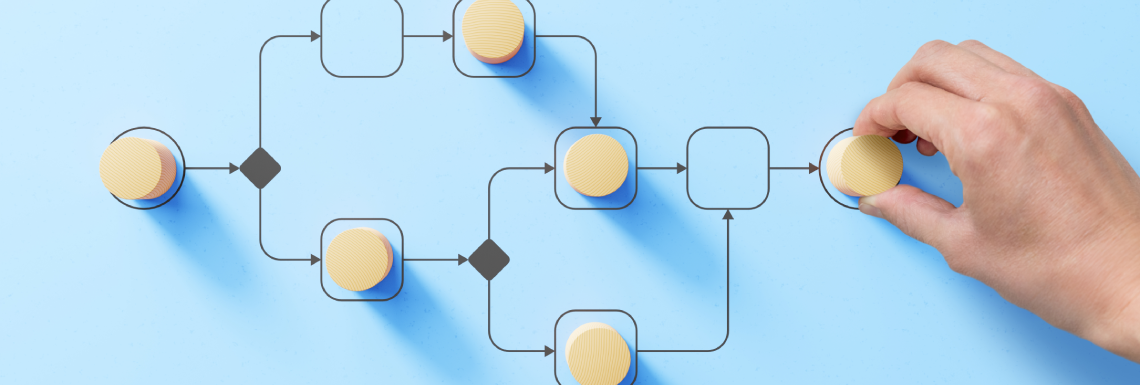

Source: abbreviationfinder.org

Executive summary

This high level overview capture the essence of the plan, highlight key objectives, major initiatives, and financial targets. It provides busy executives and board members with a quick understanding of the plan’s direction and priorities.

Market analysis and assumptions

The AOP should clear articulate the market conditions and key assumptions underlie the plan. This might include:

- Economic outlook

- Industry trends

- Competitive landscape

- Regulatory environment

- Customer behavior patterns

Document these assumptions is crucial for understanding the context of the plan and explain variances if conditions change.

Revenue plan

This section detail how the company expect to generate income, break down by:

- Product lines or service offerings

- Customer segments

- Geographic regions

- Sales channels

- Seasonality patterns

The revenue plan should align with the company’s go-to market strategy and reflect realistic growth expectations base on historical performance and market opportunities.

Expense budget

The expense portion of the AOP outline planned spending across the organization, include:

- Cost of goods sell

- Operate expenses by department

- Fix versus variable costs

- Discretionary versus non-discretionary spending

Effective expense budgeting require balance cost control with necessary investments for growth and innovation.

Capital expenditure plan

For companies make significant investments in long term assets, the capital expenditure (capex )plan is a critical component of the aoAOPThis section details:

- Major equipment purchases

- Facility expansions or improvements

- Technology infrastructure investments

- Return on investment projections

Headcount plan

People are typically one of the largest expenses for most organizations. The headcount plan outline:

- Current staffing levels

- Plan new hires by department

- Expect attrition

- Compensation and benefits projections

Key performance indicators (kKPIs)

The AOP should, will establish the metrics by which success will be will measure. TheseKPIss might include:

- Financial metrics (profit margins, return on investment, etc. )

- Operational metrics (efficiency, productivity, quality )

- Customer metrics (satisfaction, retention, lifetime value )

- Employee metrics (engagement, turnover, development )

Strategic initiatives and projects

This section will outline the major initiatives that will drive progress toward strategic goals. For each initiative, the AOP typically include:

- Objectives and expect outcomes

- Timeline and milestones

- Resource requirements

- Accountability (who own the initiative )

- Success metrics

The AOP development process

Create an effective annual operating plan involve several stages:

Strategic review

The process typically begins with a review of the company’s long term strategic plan. Thisensurese that the annual plan align with and advance the organization’s broader objectives. Leaders should assess what progress has been make on strategic goals and what priorities shoulbe emphasizedze in the come year.

Guidance and parameters

Senior leadership establish the overall parameters for the plan, include:

- Growth expectations

- Profitability targets

- Investment priorities

- Risk tolerance

These high level guidelines provide a framework for the more detailed planning that follow.

Bottom up planning

Individual departments and business units develop their own plans within the establish parameters. This bottom up approach ensures that those closest to the operations have input into the targets and resource requirements.

Consolidation and review

The finance team typically consolidate the departmental plans into a comprehensive organizational view. This consolidated plan undergo review to ensure internal consistency and alignment with strategic objectives.

Iteration and refinement

The initial consolidated plan seldom meets all requirements on the first pass. Several rounds of refinement may be necessary to balance compete priorities and ensure the plan is both ambitious and achievable.

Final approval

Formerly refine, the AOP require formal approval from senior leadership and, in many cases, the board of directors. This approval transform the plan from a proposal to an official commitment.

Source: financedetailed.com

Communication and deployment

After approval, the plan must be efficaciously communicated throughout the organization. Leaders at all levels should understand how the plan affect their areas and what’s expect of them.

Challenges in AOP development and execution

Despite its importance, the AOP process faces several common challenges:

Balance ambition with realism

Plans must stretch the organization to achieve more while remain achievable. Set targets that are overly aggressive can demoralize employees when they systematically fall short. Conversely, targets that are overly conservative may not maximize the company’s potential.

Adapt to change

The business environment seldom remains static for an entire year. Effectivetopss need mechanisms for adjust to change conditions without abandon accountability for results.

Avoid the annual ritual

For many organizations, the AOP process can become a time consume ritual that add limited value. Companies must guard against plans that are created exclusively to satisfy a corporate requirement and so shelve until the next planning cycle.

Integrate with other planning processes

The AOP must align with strategic plans, capital planning, workforce planning, and other organizational processes. This integration can be challenge, peculiarly in large, complex organizations.

Best practices for effective annual operating plans

To maximize the value of the AOP process, consider these best practices:

Start with strategy

Invariably begin the AOP process with a clear understanding of the organization’s strategic priorities. The annual plan should direct support and advance these longer term objectives.

Use zero based thinking

Instead, than but adjust last year’s numbers, challenge teams to justify their resource requirements from scratch. This approach help eliminate legacy spending that noforesightl aligns with priorities.

Build in flexibility

While the AOP provide important targets, it shouldn’t be hence rigid that it prevent adaptation to change conditions. Consider building scenario plans or establish a formal process for mid-year adjustments.

Focus on drivers, not exactly outcomes

Financial results are finally outcomes of operational activities. The virtually effective tops focus on the key drivers of performance, not exactly the financial targets themselves.

Streamline the process

Look for ways to make the planning process more efficient without sacrifice quality. This might include better technology, standardized templates, or a more focused approach to what’s include in the plan.

Connect to incentives

Ensure that performance incentive align with the priorities establish in the AOP. This connection reinforce the importance of the plan and drive accountability for results.

How tops differ across organizations

The specific approach to annual operating plans vary base on several factors:

Company size

Smaller companies may have less formal AOP processes, while large enterprises typically have extremely structure approaches with multiple layers of review and approval.

Industry characteristics

Industries with longer product development cycles (like pharmaceuticals )may emphasize different aspects of the aoAOPhan those with rapid market changes ( (ke technology ).)ikewise, capital intensive industries focus intemperately on the capex portion of the plan.

Organizational culture

Some organizations emphasize collaborative planning with broad input, while others take a more top-down approach. The level of detail and rigidity in the plan much reflect broader cultural values around control and autonomy.

Public vs. Private ownership

Publically will trade companies must, will consider how their plans will be will perceive by investors and analysts. This external scrutiny oftentimes influence both the content of the plan and how it’s communicate.

Conclusion: the strategic value of tops in finance

The annual operating plan is far more than a financial exercise. When do advantageously, it serves as a powerful tool for translate strategy into action, align resources with priorities, and drive accountability throughout the organization.

In today’s apace change business environment, the virtually effective tops balance structure with flexibility. They provide clear direction while allow for adaptation as conditions evolve.

For finance professionals and business leaders, master the AOP process is a critical skill. It requires not but financial acumen but besides strategic thinking, operational understanding, and effective communication.

By invest in a thoughtful, collaborative approach to annual planning, organizations can increase their chances of achieve both short term performance targets and long term strategic objectives. The AOP serve as the bridge between aspiration and execution, turn business strategy into operational reality.

MORE FROM nicoupon.com