Crane Finance: Legitimacy Analysis and Consumer Guide

Understand crane finance: a comprehensive review

When seek equipment financing solutions, especially for heavy machinery like cranes, businesses oftentimes encounter crane finance as an option. The question of legitimacy course arise when consider any financial service provider. This analysis examine crane finance’s operations, reputation, and customer experiences to provide clarity for potential clients.

What’s crane finance?

Crane finance present itself as a specialized finance company focus on equipment financing solutions, peculiarly for construction, manufacturing, and industrial sectors. They offer various financial products include:

- Equipment leasing

- Equipment loans

- Work capital solutions

- Sale leaseback arrangements

- Refinance options

The company claim to work with businesses of various sizes, from small operations to large enterprises, provide tailor financing solutions for equipment acquisition needs.

Legitimacy indicators for financial service providers

Before assess crane finance specifically, it’s important to understand the key indicators of legitimacy for any financial service provider:

Regulatory compliance and licensing

Legitimate financial companies maintain appropriate licenses and registrations with relevant financial regulatory authorities. Depend on their operational scope, this might include state level licenses, federal registrations, or industry specific certifications.

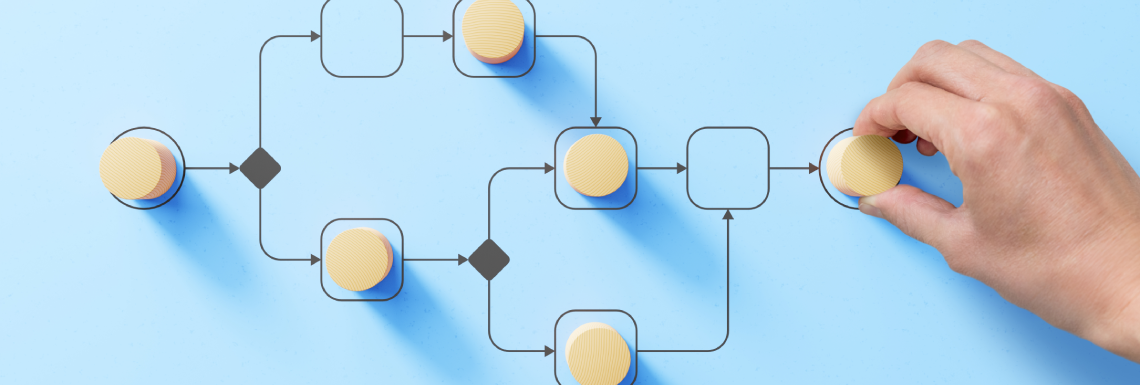

.png)

Source: cranefinance.com

Transparent business practices

Legitimate financing companies maintain transparency in their:

- Interest rates and fee structures

- Contract terms and conditions

- Prepayment penalties and options

- Application and approval processes

Established business presence

Indicators of an establish business include:

- Physical business address (not upright a p.o. box )

- Professional website with comprehensive information

- Verifiable contact information

- Consistent company history

- Industry association memberships

Customer reviews and reputation

While no company have perfect reviews, legitimate businesses typically have:

- A pattern of largely positive customer feedback

- Transparent handling of complaints

- Active engagement with customer concerns

- Absence of widespread fraud allegations

Evaluate crane finance’s legitimacy

Business registration and licensing

Research into crane finance should begin with verify their business registration status. Legitimate equipment financing companies maintain proper business registrations in states where they operate and hold appropriate lending licenses.

Potential clients should verify:

- State business registration status

- Lend licenses in operating jurisdictions

- Better business bureau (bBBB)registration and rating

- Industry association memberships

Company history and stability

The longevity of a financial services provider oftentimes correlate with legitimacy. Companies that have operated successfully for extend periods typically demonstrate:

- Consistent market presence

- Establish industry relationships

- Stable management team

- Verifiable client portfolio

Contract transparency

Legitimate financing companies provide clear, detailed contracts that specify:

- Complete cost breakdown include interest rates and fees

- Payment schedules and terms

- Early payoff options and associated costs

- Default consequences and remediation processes

- Equipment ownership terms

Red flags include vague contracts, hide fees, or pressure to sign without thorough review.

Customer experiences with crane finance

Review platforms and testimonials

Customer reviews provide valuable insights into a company’s operational practices. When evaluate crane finance’s legitimacy, consider:

- Reviews across multiple platforms (tTrustpilot bBBB google )

- Industry specific forums and discussions

- Testimonials from verifiable businesses

- Patterns in positive and negative feedback

Look beyond star ratings to understand specific experiences customers have with application processes, customer service, contract fulfillment, and issue resolution.

Common positive feedback patterns

Legitimate financing companies oftentimes receive positive feedback regard:

- Streamlined application processes

- Transparent fee structures

- Responsive customer service

- Flexible financing options

- Timely funding

- Fair treatment during financial hardships

Common complaint patterns

Watch for recur complaints that might indicate problematic business practices:

- Unexpected fees or charges

- Contract terms that differ from verbal promises

- Difficulty contact representatives

- Aggressive collection practices

- Mislead advertising

More important than the presence of complaints is how the company respond to and resolve issues.

Alternatives to crane finance

Traditional equipment financing options

When consider equipment financing, businesses have several alternatives:

- Bank loans: Traditional banks offer equipment loans with competitive rates for qualified borrowers

- Credit unions: Oftentimes provide favorable terms for members

- SBA loans: Government back loans with favorable terms for eligible small businesses

- Manufacturer financing: Direct financing options from equipment manufacturers

Specialized equipment financiers

The equipment financing industry include numerous specialized lenders:

- Industry specific financing companies

- National equipment leasing corporations

- Regional specialty lenders

Compare multiple options help ensure competitive terms and appropriate financing structures.

Source: cranefinance.com

Due diligence before commit to equipment financing

Research and verification steps

Before sign any financing agreement with crane finance or any provider, businesses should:

- Verify the company’s registration and licensing status

- Request and check references from current clients

- Review sample contracts before application

- Understand all fees and potential charges

- Calculate the total cost of financing over the term

- Compare offer from multiple providers

- Consult with a financial advisor or attorney

Red flags to watch for

Be cautious of finance companies that exhibit these warning signs:

- Pressure to sign promptly without review

- Reluctance to provide write quotes

- Vague or inconsistent answers about terms

- Remarkably high fees or interest rates

- Requests for upfront payments before approval

- Limited or non-existent online presence

- Unwillingness to provide references

Understanding equipment financing structures

Loans vs. Leases

Equipment financing typically falls into two categories:

Equipment loans

With equipment loans, the business:

- Borrow money to purchase equipment unlimited

- Own the equipment instantly

- Use the equipment as collateral

- Builds equity with each payment

- May qualify for tax benefits include depreciation

- Assumes responsibility for maintenance and repairs

Equipment leases

With equipment leases, the business:

- Make regular payments for equipment use

- Doesn’t own the equipment during the lease term

- May have lower monthly payments than loans

- Oftentimes include maintenance options

- May have end of term purchase options

- Can deduct lease payments as business expenses

Finance terms and considerations

When evaluate financing offers, assess:

- Interest rates: Fix vs. Variable rates and how they compare to market averages

- Term length: How duration affect monthly payments and total cost

- Down payment requirements: Initial capital need to secure financing

- Balloon payments: Whether large end of term payments are required

- Early payoff options: Penalties or savings for pay beforehand of schedule

- Tax implications: How different structures affect tax liability

Make an informed decision

Align financing with business needs

The right financing solution depend on your specific business circumstances:

- Cash flow considerations: How payment schedules align with revenue patterns

- Equipment lifecycle: Whether technology obsolescence is a concern

- Growth projections: How financing affect future borrowing capacity

- Tax strategy: Leverage deductions and depreciation benefits

- Exit strategy: End of term options that align with business plans

Documentation and protection

Protect your business interests by:

- Get all promises in write

- Maintain complete documentation

- Understand contract termination provisions

- Know your rights under consumer protection laws

- Secure appropriate insurance coverage

Conclusion: is craned finance legitimate?

Determine the legitimacy of crane finance require thorough research into their specific business practices, regulatory compliance, and customer experiences. Legitimate financing companies maintain proper licensing, transparent business practices, clear communication, and fair contract terms.

Kinda than rely entirely on online reviews or company claims, potential clients should:

- Verify business credentials through official channels

- Speak with current or past clients

- Review actual contract terms

- Compare offer against industry standards

- Consult with financial advisors

Equipment financing represent a significant business commitment. Take time for proper due diligence ensure you partner with a reputable provider that align with your business needs and financial goals.

Remember that legitimacy exist on a spectrum quite than as a simple yes or no determination. The virtually appropriate financing partner for your business depend on your specific circumstances, risk tolerance, and financing requirements.

By apply the evaluation framework outline in this guide, businesses can make informed decisions about crane finance or any equipment financing provider they’re considered.

MORE FROM nicoupon.com