Credit Card Finance Charges: Complete Guide to Understanding Costs and Fees

What are credit card finance charges?

Credit card finance charges represent the cost of borrow money from your credit card issuer. These charges apply when you carry a balance from month to month, basically pay interest on the amount you owe. Finance charges encompass various fees and interest costs that accumulate when you don’t pay your full statement balance by the due date.

The primary component of finance charges is interest, calculate use your card’s annual percentage rate (aApr) Notwithstanding, finance charges can besides include cash advance fees, balance transfer fees, and penalty charges for late payments or exceed your credit limit.

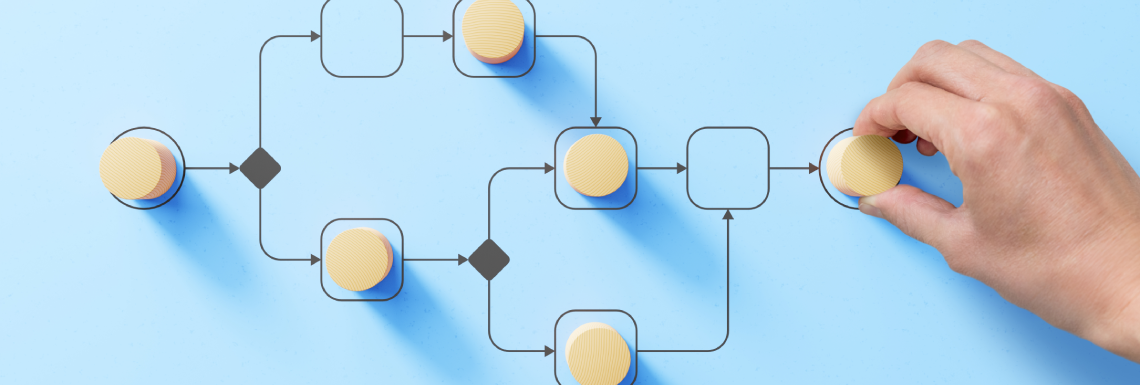

How finance charges are calculated

Credit card companies use several methods to calculate finance charges, with the average daily balance method being virtually common. This calculation consider your balance each day during the billing cycle, so apply the daily periodic rate.

Source: picserver.org

The daily periodic rate equal your Apr divide by 365 days. For example, if your Apr is 18 %, your daily rate would be roughly 0.049 %. The issuer multiply this rate by your average daily balance throughout the billing cycle to determine your finance charge.

Some issuers use the adjusted balance method, calculate interest exclusively on the remain balance after payments and credits are applied. Others employ the previous balance method, base charges on the balance from your last statement irrespective of payments make during the current cycle.

Types of finance charges

Interest charges

Interest charges form the largest portion of finance charges for most cardholders. These charges apply to purchase balances, cash advances, and balance transfers. Purchase APRS typically range from 15 % to 25 %, while cash advance APRS much run high.

Cash advance fees

Cash advance finance charges include both fees and interest. The fee normally ranges from 3 % to 5 % of the advance amount, with a minimum fee of$55 to $10. Interest begin accrue instantly on cash advances, with no grace period.

Balance transfer fees

Balance transfer fees typically cost 3 % to 5 % of the transfer amount. While promotional rates might offer 0 % Apr for a limited time, the transfer fee notwithstanding applies upfront.

Penalty fees

Late payment fees and over limit fees contribute to finance charges. Late fees can reach $40 for repeat violations, while over limit fees may cost up to $$25per occurrence where permit.

Source: picpedia.org

Grace periods and when finance charges apply

Most credit cards offer a grace period of 21 to 25 days for new purchases when you pay your full statement balance by the due date. During this period, no interest accrue on new purchases. Notwithstanding, this grace period disappears when you carry a balance from the previous month.

Cash advances and balance transfers typically don’t qualify for grace periods. Interest begin accumulate instantly on these transactions. Once you lose your grace period by carry a balance, new purchases likewise start accrue interest instantly until you pay the full balance and restore the grace period.

Factors affect your finance charges

Annual percentage rate

Your Apr importantly impact finance charges. Credit card APRS vary base on your creditworthiness, the type of card, and market conditions. Prime rate changes affect variable APRS, potentially increase or decrease your finance charges.

Balance amount

Higher balances generate larger finance charges. Yet small increases in your carry balance can considerably impact monthly interest costs over time.

Payment timing

When you make payments affect your average daily balance. Earlier payments reduce the balance for more days in the billing cycle, lower finance charges.

Payment amount

Minimum payments scarcely cover interest and fees, keep balances high. Larger payments reduce principal fasting, decrease future finance charges.

Strategies to minimize finance charges

Pay balances in full

The almost effective strategy involves pay your entire statement balance by the due date each month. This approach eliminate interest charges on purchases and maintain your grace period.

Make multiple payments

Make payments throughout the month reduce your average daily balance, lower finance charges evening when carry a balance. Consider make payments weekly or bi-weekly.

Pay more than the minimum

Pay more than the minimum require payment reduce principal fasting. Yet an extra $25 monthly can importantly decrease total interest pay over time.

Prioritize high interest debt

If you have multiple cards, focus extra payments on the highesAprpr balances 1st. This debt avalanche method minimize total interest costs.

Understand your credit card statement

Credit card statements clear display finance charges in a dedicated section. Look for the” interest charge ” ine item, which break down charges by transaction type. The statement likewise shshowsour aAprfor different transaction categories.

The minimum payment calculation include current finance charges plus a portion of the principal balance. Understand this breakdown help you see how much of your payment cover interest versus reduce your debt.

Promotional rates and finance charges

Many credit cards offer promotional APRS for new customers or specific transaction types. These promotions might include 0 % Apr on purchases or balance transfers for 12 to 21 months. Notwithstanding, the promotional rate applies exclusively to qualifying transactions during the specify period.

After promotional periods end, the regular Apr apply to remain balances. Cash advances typically don’t qualify for promotional rates and incur standard finance charges directly.

Legal protections and regulations

The credit card accountability responsibility and disclosure act provide important protections regard finance charges. Issuers must give 45 days’ notice before increase APRS on exist balances. They can not apply rate increases to exist balances unless you’re more than 60 days belated on payments.

The law too requires that payments above the minimum amount go toward the highestAprr balances firstly, help reduce the virtually expensive debt profligate.

Impact on credit scores

While finance charges themselves don’t direct affect credit scores, the underlie factors do. High balances that generate substantial finance charges increase your credit utilization ratio, potentially lower your score. Late payments that trigger penalty APRS and additional fees can gravely damage your credit rating.

Maintain low balances and make timely payments keep finance charges minimal while support healthy credit scores.

Alternatives to carry credit card balances

Personal loans

Personal loans oftentimes offer lower interest rates than credit cards, specially for borrowers with good credit. Fix rates and structured payment plans can reduce total interest costs compare to revolve credit card debt.

Home equity options

Home equity loans or lines of credit typically provide lower rates than credit cards. Notwithstanding, these options use your home as collateral, create additional risk.

Balance transfer cards

Balance transfer credit cards with promotional 0 % Apr periods can provide temporary relief from finance charges. Success require discipline to pay off balances before promotional rates expire.

Long term financial planning

Minimize finance charges support broader financial goals. Money save on interest can go toward emergency funds, retirement savings, or other investments. Create a budget that prioritize debt repayment help break the cycle of accumulate finance charges.

Consider automate payments to ensure you ne’er miss due dates. Flush small improvements in payment timing and amounts can yield significant savings over time.

When to seek professional help

If finance charges consume a large portion of your income, oryoure sstruggledto make minimum payments, consider speak with a nonprofit credit counseling agency. These organizations can help create debt management plans and negotiate with creditors.

Debt consolidation might likewise provide relief by combine multiple high interest balances into a single, lower rate payment. Yet, this strategy requires discipline to avoid accumulate new debt.

Understand credit card finance charges empower you to make informed decisions about borrowing and repayment. By implement strategies to minimize these costs, you can save money and improve your overall financial health. Remember that small changes in payment behavior can yield substantial long term benefits, make it worthwhile to actively manage your credit card usage and payments.

MORE FROM nicoupon.com