Finance Career Paths: Ideal Roles for Master’s Degree Holders

Finance career paths for master’s degree holders

A master’s degree in finance or a related field represent a significant investment in your professional future. This advanced education open doors to specialized roles that typically offer higher compensation, greater responsibility, and enhance career mobility. But with numerous paths available in the finance sector, identify the ideal position that align with your skills, interests, and long term goals require careful consideration.

Top finance careers for master’s graduates

Financial manager

Financial managers represent one of the near seek after positions for finance professionals with advanced degrees. These executives oversee the financial health of organizations, develop strategies for long term financial goals while direct investment activities and produce financial reports.

With a master’s degree, you’re fountainhead position for senior financial manager roles that typically offer annual salaries range from $130,000 to $$200000 or more, depend on the industry and location. The bureau of labor statistics project a 15 % growth rate for financial manager positions, practically fifirmer thanverage for all occupations.

Financial managers benefit from the specialized knowledge gain through a master’s program, specially in areas like financial analysis, risk management, and strategic planning. Many organizations specifically seek candidates with graduate level education for these critical leadership positions.

Investment banker

Investment banking remain one of the virtually lucrative career paths for finance professionals with advanced degrees. While entry level positions are accessible with a bachelor’s degree, a master’s importantly accelerate your path to associate and vice president positions.

Investment bankers typically assist organizations in raise capital, manage mergers and acquisitions, and provide strategic financial advice. The role demand exceptional analytical abilities, financial modeling expertise, and strong communication skills — all areas emphasize in master’s level finance programs.

Compensation packages for investment bankers with master’s degrees usually include base salaries of $125,000 to $$200000, with bonuses that can double or triple this amount base on performance and market conditions. The work oftentimes ininvolvesong hours and high pressure, but the financial rewards and career advancement opportunities are substantial.

Financial analyst

While financial analyst positions exist at various levels, those with master’s degrees typically qualify for senior and specialized analyst roles. These positions focus on evaluate investment opportunities, analyze financial data, and make recommendations that guide business decisions.

Senior financial analysts with master’s degrees usually earn between $90,000 and $$120000 yearly, with additional compensation through bonuses and profit share arrangements. The position serve as an excellent step stone to more advanced roles like portfolio manager or investment strategist.

The technical knowledge gain through a master’s program — specially in areas like financial modeling, valuation techniques, and quantitative analysis — provide a significant advantage in this field. Many employers specifically seek candidates with graduate education for senior analyst positions.

Portfolio manager

Portfolio managers oversee investment portfolios for individuals, organizations, or funds. This role requires deep understanding of various asset classes, risk management principles, and market dynamics — all areas cover extensively in master’s level finance programs.

With a master’s degree, you can bypass many entry level positions and move direct into associate portfolio manager roles, with potential advancement to senior portfolio manager positions. Annual compensation typically ranges from$1200,000 to $250,000, with significant performance base bonuses possible.

The role offer intellectual stimulation through continuous market analysis and investment strategy development. Portfolio managers benefit from the advanced knowledge of investment theory, risk assessment, and portfolio construction techniques cover in graduate finance programs.

Risk manager

Risk management has emerged as one of the virtually critical functions within financial institutions, specially follow the 2008 financial crisis. Risk managers identify, analyze, and mitigate potential threats to an organization’s financial health and stability.

A master’s degree with specialization in risk management or financial engineering provide ideal preparation for roles like senior risk analyst or enterprise risk manager. These positions typically offer salaries range from $110,000 to $$180000, with additional performance base compensation.

The role require sophisticated understanding of risk assessment methodologies, statistical modeling, and regulatory frameworks — all areas where graduate level education provide significant advantages. As financial regulations continue to evolve, demand for qualified risk management professionals remain strong.

Chief financial officer (cCFO)

While typically require significant experience in addition to advanced education, the chief financial officer position represent a potential career pinnacle for finance professionals with master’s degrees. CFOs oversee all financial operations of an organization, from accounting and financial reporting to strategic planning and investor relations.

The path to CFO frequently involve progression through various financial leadership roles, with a master’s degree serve as a crucial qualification. Compensation packages usually exceed $200,000 yearly, with substantial bonuses and equity components in many organizations.

The role demand comprehensive financial knowledge combine with strategic business acumen — a combination advantageously develop through graduate finance programs, specially those with business management components like MBA programs with finance concentrations.

Financial consultant

Financial consulting offer significant opportunities for those with master’s level finance education. As a consultant, you will advise organizations on financial strategies, operational improvements, and regulatory compliance issues.

Master’s degree holders typically enter consulting firms at higher levels, bypass junior positions and move direct into associate or senior consultant roles. Annual compensation normally ranges from$1000,000 to $150,000, with performance bonuses and profit share arrangements.

The role will offer exceptional variety, as you will work with different clients across various industries, will apply your specialized financial knowledge to will diverse business challenges. The analytical skills and theoretical understanding develop during graduate studies provide a strong foundation for success in this field.

Quantitative analyst

For those with strong mathematical abilities and programming skills, quantitative analyst (” quant ” positions offer intellectually stimulating and financially rewarding careers. Quants develop mathematical models to analyze financial markets, assess risk, and identify trading opportunities.

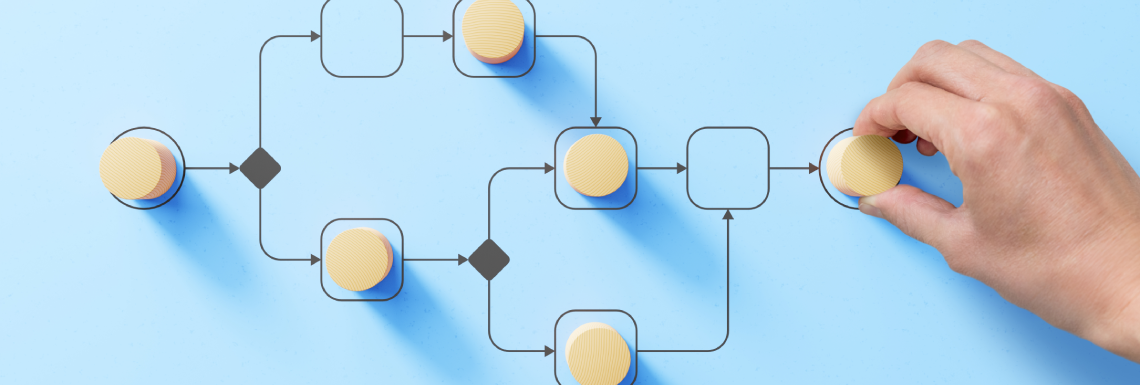

Source: bepublishing.com

A master’s degree in financial engineering, computational finance, or a related field provide ideal preparation for these roles. Annual compensation typically ranges from$1255,000 to $200,000, with significant performance base bonuses in many organizations.

The position require advanced mathematical knowledge, statistical expertise, and programming skills — areas emphasize in specialized finance master’s programs. As financial institutions progressively rely on algorithmic trading and quantitative risk assessment, demand for qualified professionals continue to grow.

Factors to consider when choose a finance career

Work-life balance

Different finance careers offer vary work-life balance arrangements. Investment banking and trading positions typically involve long hours and high stress levels, while corporate finance roles oftentimes provide more predictable schedules. Consider your personal priorities when evaluate potential career paths.

Industry preferences

Finance professionals work across almost every industry, from banking and investment management to healthcare, technology, and manufacturing. Consider which sectors align with your interests and values, as industry knowledge oftentimes complement financial expertise in specialized roles.

Geographic considerations

While financial hubs like New York, London, and Hong Kong offer the highest concentration of opportunities, finance positions exist nationwide. Consider your geographic preferences and mobility constraints when evaluate potential career paths.

Specialization vs. Generalization

Some finance careers reward deep specialization in areas like derivatives pricing or mergers and acquisitions, while others value broader financial knowledge. Your master’s program potential emphasize certain areas; consider how these specializations align with potential career paths.

Source: degreeplanet.com

The ideal finance career: find your perfect match

While financial compensation course influence career decisions, the ideal finance positions balance monetary rewards with personal satisfaction, professional growth, and lifestyle considerations. Base on these factors, several positions emerge as specially advantageously suit for master’s degree holders:

For analytical thinkers: risk manager or quantitative analyst

If you excel at quantitative analysis and enjoy solve complex problems, roles in risk management or quantitative analysis offer intellectually stimulate work with strong compensation. These positions leverage the advanced analytical skills develop during graduate studies while provide reasonable work-life balance compare to some other finance specialties.

For strategic thinkers: portfolio manager or financial consultant

Those who enjoy develop comprehensive strategies and see their implementation might find portfolio management or financial consulting specially rewarding. These roles combine analytical requirements with strategic thinking and oftentimes involve client interaction, provide varied and engage work environments.

For leadership orient professionals: financial manager or CFO track

If your ambitions include organizational leadership, positions in financial management provide a path toward executive roles. These careers combine financial expertise with management responsibilities, offer significant influence over organizational direction and strategy.

Leverage your master’s degree for career advancement

Professional certifications

While your master’s degree provide a strong foundation, complementary professional certifications can air enhance your qualifications. Depend on your career focus, consider pursue designations like:

- Chartered financial analyst (cCFA)for investment and portfolio management roles

- Certified financial planner (cCFP)for wealth management positions

- Financial risk manager (fFRM)for risk management careers

- Chartered alternative investment analyst (cCIA))or alternative investments focus

Many master’s programs align with certification requirements, potentially reduce the additional study need to obtain these credentials.

Network strategies

The finance industry place significant emphasis on professional networks. Leverage your master’s program alumni connections, participate in industry associations, and maintain relationships with professors and classmates. These connections oftentimes provide access to unadvertised opportunities and valuable mentorship.

Continuing education

The financial landscape evolve endlessly through regulatory changes, technological innovations, and shift market dynamics. Commit to ongoing learning through professional development programs, industry conferences, and self direct study to maintain your competitive edge.

Conclusion: make your decision

The ideal finance career for someone with a master’s degree finally depend on individual factors include personal interests, strengths, lifestyle preferences, and long term goals. The good news is that your advanced education provide access to numerous rewarding paths, each offer unique advantages.

Consider conduct informational interviews with professionals in roles that interest you to gain firsthand insights into daily responsibilities, challenges, and rewards. Many master’s programs maintain alumni networks specifically for this purpose.

Remember that career paths seldom follow straight lines. Many successful finance professionals have move between different specializations, leverage their core financial knowledge while gain diverse experiences. Your master’s degree provide the foundation for this flexibility, allow you to adapt as your interests and the industry evolve.

With thoughtful consideration of your priorities and strengths, you can identify the finance career that not but reward you financially but besides provide the intellectual stimulation and personal satisfaction that sustain long term career success.

MORE FROM nicoupon.com