PhD in Finance: Complete Guide to Doctoral Education in Financial Studies

Understand the PhD in finance

A PhD in finance represent the highest academic achievement in the field of financial studies. This doctoral degree prepare individuals for careers in advanced research, academia, and specialize financial analysis. Unlike master’s programs that focus on practical application, a finance PhD emphasize original research contributions and theoretical advancements in the discipline.

The decision to pursue a PhD in finance should be cautiously considered, as these programs typically require 4 6 years of intensive study and research commitment. They’re design for those who want to push the boundaries of financial knowledge kinda than buapply to existst principles.

Program availability and structure

Finance PhD programs are offer at many prestigious universities worldwide. In the uUnited States these programs are typically house within business schools or economics departments. Some institutions offer dedicated finance doctoral programs, while others include finance as a specialization within a broader business or economics pPhD

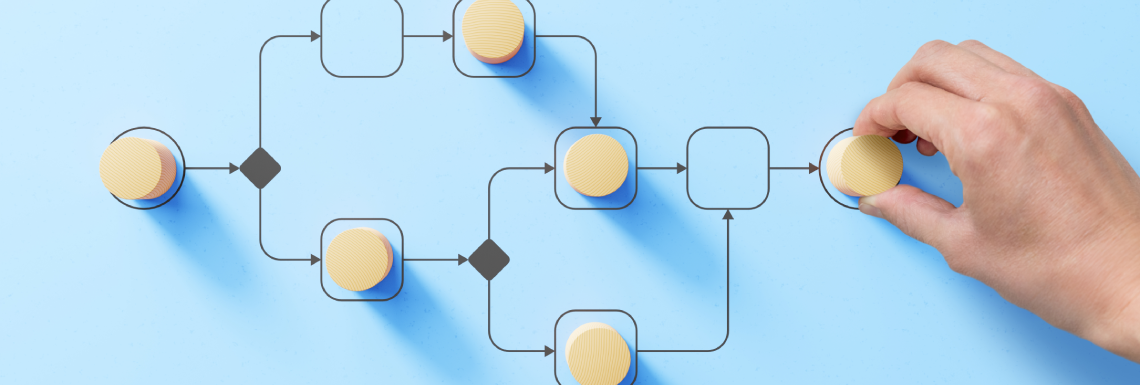

The structure of a PhD in finance program mostly include:

- Coursework phase (1 2 years ) advanced courses in financial theory, econometrics, mathematics, statistics, and research methodologies

- Comprehensive examinations: test mastery of core finance concepts and research methods

- Dissertation proposal: present and defend a unique research agenda

- Dissertation research and writing (2 4 years ) conduct original research under faculty supervision

- Dissertation defense: present and defend research findings before a committee

Most programs follow a similar progression, though specific requirements vary by institution. The coursework phase builds the theoretical foundation necessary for advanced research, while the dissertation represent the student’s original contribution to financial knowledge.

Admission requirements

Gain admission to a finance PhD program is extremely competitive. Typical requirements include:

Academic background

Nearly successful applicants possess:

- A master’s degree in finance, economics, mathematics, or related field (though some programs accept exceptional candidates with only bachelor’s degrees )

- Strong academic performance with gas typically above 3.5 on a 4.0 scale

- Demonstrate aptitude in quantitative subjects

Test scores

Competitive applications broadly include:

- High GRE or GMAT scores, specially in the quantitative sections

- For international students, strong TOEFL or IELTS scores

Research potential

Admissions committees look for evidence of research capability through:

- Prior research experience or publications

- A compelling research proposal or statement of interest

- Strong letters of recommendation from academic references

The well-nigh selective programs admit solely a handful of students each year, make preparation and strategic application essential for prospective candidates.

Curriculum and specializations

The PhD in finance curriculum combine rigorous theoretical foundations with specialized research training. Core coursework typically include:

Foundation courses

- Advanced financial theory

- Asset pricing

- Corporate finance

- Financial markets and institutions

- Mathematical methods for finance

- Econometrics and statistical analysis

Research methodology

- Quantitative research methods

- Empirical research in finance

- Financial modeling

- Research design and data analysis

Common specializations

Within finance, doctoral students typically specialize in areas such as:

- Corporate finance: focus on capital structure, corporate governance, and financial decision make

- Asset pricing: study how assets are value in markets and the factors that influence returns

- Financial markets: analyze market behavior, efficiency, and regulation

- Banking and financial institutions: examine the role and operations of financial intermediaries

- Behavioral finance: investigate psychological factors affect financial decisions

- International finance: study global financial systems and cross border financial issues

- Financial econometrics: develop statistical methods for analyzing financial data

The specialization frequently determines the direction of the student’s dissertation research and subsequent career focus.

Research requirements and dissertation

The dissertation represent the core of a finance PhD program and typically constitute the majority of a student’s time and effort. This original research project must:

- Address a significant gap in financial knowledge or theory

- Employ rigorous research methodologies

- Contribute meaningfully to the field

- Withstand peer scrutiny

The dissertation process involve several key stages:

Proposal development

Students work with faculty advisors to develop a research proposal that outline:

- The research question and its significance

- Theoretical framework

- Methodology and data sources

- Expect contributions to the field

Data collection and analysis

Finance dissertations typically involve:

- Gather financial or market data from various sources

- Apply sophisticated statistical or econometric methods

- Test hypotheses or financial models

- Interpret results within theoretical frameworks

Writing and defense

The final stages include:

- Write a comprehensive dissertation document (frequently 150 300 pages )

- Defend the research before a committee of faculty experts

- Publish findings in academic journals (frequently before graduation )

Throughout this process, students work intimately with a dissertation committee, typically consist of 3 5 faculty members with expertise relevant to the research topic.

Funding and financial considerations

The financial aspects of pursue a PhD in finance deserve careful consideration. Unlike professional degrees, most finance doctoral programs offer funding packages to admit students, which may include:

Source: degreeplanet.com

- Tuition waivers cover all or most educational costs

- Annual stipends range from $20,000 to $$40000 ( (ries by institution ) )

- Health insurance benefits

- Conference travel funds

- Research grants or fellowships

These funding packages typically require students to work as teaching or research assistants for 15 20 hours per week. While the stipends may seem modest compare to private sector finance salaries, they allow students to focus on their studies without accumulate significant debt.

Additional funding sources may include:

- External fellowships from organizations like the national science foundation

- Dissertation completion grants

- Summer research funding

The opportunity cost of foregone earnings represent the largest financial consideration, as students typically spend 4 6 years earn modest stipends sooner than industry salaries.

Career opportunities with a finance PhD

A PhD in finance open doors to several career paths, with academia being the near common destination. Career options include:

Academic careers

- University professor: teaching finance courses and conduct research at colleges and universities

- Research fellow: focus chiefly on research at academic institutions or think tanks

- Academic administrator: lead finance departments or research centers

Academic positions offer intellectual freedom, job security through tenure, and the opportunity to shape future finance professionals. Start salaries for finance professors at research universities typically range from $150,000 to $$250000, with top candidates command fififtyigher compensation.

Industry positions

- Research economist: conduct advanced financial research at central banks, regulatory agencies, or international organizations

- Quantitative analyst: develop sophisticated financial models at investment banks or hedge funds

- Risk management specialist: designing advanced risk assessment frameworks for financial institutions

- Investment strategist: create research base investment approaches for asset management firms

- Financial consultant: provide expert guidance on complex financial issues

While industry positions may offer higher compensation, they typically provide fewer opportunities for independent research compare to academic roles.

Pros and cons of pursue a finance PhD

Before commit to a PhD in finance, prospective students should weigh several advantages and challenges:

Advantages

- Intellectual development and mastery of advanced financial concepts

- Opportunity to contribute to financial knowledge through original research

- Access to academic careers with intellectual freedom and job security

- Development of extremely transferable analytical and research skills

- Funding support throughout the program (unlike many professional degrees )

- Prestige and credibility in financial circles

Challenges

- Significant time commitment (4 6 years of intensive study )

- High opportunity cost in terms of foregone earnings

- Rigorous intellectual demands and research expectations

- Competitive academic job market with geographic mobility requirements

- Potential isolation during the dissertation phase

- Less direct application to many financial industry roles compare to a mMBAor master’s in finance

The decision finally depends on career goals, research interests, and personal circumstances. Those principally interested in industry positions might find master’s programs more efficient, while those will passionate about financial research and teaching will find thePhDd invaluable.

Alternatives to a finance PhD

For those interested in advanced finance education but uncertain about a PhD commitment, several alternatives exist:

Master’s degrees

- Master of science in finance: provide advanced technical knowledge in 1 2 years

- MBA with finance concentration: combines finance with broader business education

- Master’s in financial engineering: focus on quantitative methods and financial modeling

Professional certifications

- Chartered financial analyst (cCFA) extremely respected designation focus on investment analysis

- Financial risk manager (fFRM) specialized certification in risk management

- Chartered alternative investment analyst (cCIA))focuses on alternative investments

Executive education

- Specialized finance courses and certificates offer by business schools

- Industry specific training programs

These alternatives require less time commitment while however enhance financial expertise and career prospects, especially for those focus on industry sooner than academic careers.

Source: degreeplanet.com

Is a PhD in finance right for you?

The decision to pursue a PhD in finance should align with your career aspirations, intellectual interests, and personal circumstances. Consider these questions:

- Do you have a passion for financial research and theory development?

- Are you interested in an academic career teaching and research finance?

- Can you commit to 4 6 years of intensive study with modest financial compensation?

- Do you enjoy work severally on complex analytical problems?

- Are you comfortable with the quantitative and statistical demands of finance research?

If you answer yes to most of these questions, a PhD in finance might be an excellent fit. Nonetheless, if your primary goal is to advance in the financial industry or increase your earn potential in the short term, alternative credentials may be more appropriate.

The virtually successful finance PhD candidates possess strong quantitative abilities, genuine intellectual curiosity, exceptional perseverance, and clear research interests. They view the PhD not but as a credential but as an opportunity to develop expertise and contribute to financial knowledge.

Conclusion

A PhD in finance represent a significant academic achievement and open doors to specialized careers in research, academia, and advanced financial analysis. The program demand substantial commitment — intellectually, financially, and in terms of time — but offer unique rewards for those passionate about financial theory and research.

For the right candidates, a finance doctorate provides not fair career advancement but intellectual fulfillment through contribute to the understanding of financial systems anddecision-makingg. Nevertheless, prospective students should cautiously evaluate their goals, interests, and alternatives before embark on this challenge academic journey.

Whether a PhD in finance is the right path depend on individual circumstances and aspirations. Those who choose this path join a select community of financial scholars dedicate to expand the frontiers of financial knowledge and educate future generations of finance professionals.

MORE FROM nicoupon.com