Reference Data in Finance: Essential Foundation for Financial Operations

Understanding reference data in finance

Reference data form the foundation of financial systems and processes across the banking and investment industries. It consists of to standardize, nnon-transactionaldata that financial institutions use to complete transactions, generate reports, and maintain regulatory compliance. Unlike market data that change oftentimes, reference data remain comparatively static and serve as a reliable point of reference for financial operations.

Types of financial reference data

Securities reference data

Securities reference data include fundamental information about financial instruments that seldom change:

- Identifiers iSins( (ternational secsecurities’entification numbers ))cuscuspsco(ittee on uniform securities identification procedures ), s)olsmedalsc(exchange daily official list ), and)ics ( rrichr(iReutersnt codes ) )

- Classification data asset class, instrument type, sector, and industry classifications

- Static attributes issue date, maturity date, coupon rate, and face value

- Corporate actions stock splits, mergers, dividends, and name changes

Counterparty reference data

This data category contain information about entities with which financial institutions conduct business:

- Entity identifiers leis ((egal entity identifiers ))bicBICsb(iness identifier codes ), )d other organization codes

- Hierarchical relationships parent subsidiary structures and ultimate beneficial ownership

- Credit ratings standard & poor’s, moody’s, and fFitchratings

- Regulatory classifications entity types for compliance purposes

Market reference data

While distinct from real time market data, market reference data include:

Source: academy.onetick.com

- Exchange information trading venues, operating hours, and holiday schedules

- Currency data iISOcurrency codes and conversion standards

- Benchmark rates lLIBOR((eing phase out ))sofsofturMaribornd other reference rates

- Index constituents components of major indices like sS&P 500or fFTSE 100

Regulatory reference data

This specialized category support compliance with various financial regulations:

- Sanctions lists oOFAC eEU and uUNsanctions designations

- Pep (politically expose persons ) Databases

- Regulatory reporting codes mIFIDii, doDoddrank, and emir identifiers

- Tax relate information tax jurisdictions and withholding requirements

The critical role of reference data in financial operations

Transaction processing

Reference data enable the accurate execution of financial transactions by provide the standardized information need to identify instruments, counterparties, and applicable rules. Without precise reference data, transactions may fail to settle or could be process falsely, lead to financial losses and operational inefficiencies.

For example, when execute a cross border securities trade, systems rely on reference data to identify the correct instrument use the appropriate identifier (iISIN ccusp))determine the settlement location, apply the correct tax treatment base on jurisdictional rules, and ensure compliance with relevant regulations.

Risk management

Financial institutions depend on reference data to assess and manage various risk exposures:

- Credit risk counterparty reference data help institutions evaluate the creditworthiness of entities they do business with

- Market risk instrument characteristics from securities reference data inform risk models

- Concentration risk entity hierarchies help identify hidden exposures to related counterparties

- Liquidity risk instrument classifications help determine asset liquidity profiles

Regulatory compliance

The regulatory landscape for financial institutions has grown progressively complex. Reference data play a crucial role in meet these requirements:

- Transaction report mIFIDii, emir, and doDoddrank require specific identifiers and classifications

- KYC (know your customer ) entity reference data support customer due diligence

- AML (aanti-moneylaundering ) sanctions and pep data help screen for high risk relationships

- Basel requirements reference data support capital adequacy calculations

Financial reporting

Accurate financial reporting rely heavy on standardize reference data:

Source: thedatagovernor.info

- Portfolio valuation securities reference data provide the attributes need for pricing models

- Performance attribution classification data enable bbenchmarkagainst appropriate indices

- Financial statements entity hierarchies determine consolidation requirements

- Tax reporting jurisdiction and instrument data inform tax calculations

Reference data management challenge

Data quality issues

Despite its critical importance, reference data oftentimes suffer from quality problems:

- Incompleteness miss attributes for certain instruments or entities

- Inaccuracy incorrect information that can lead to processing errors

- Inconsistency different versions of the same data across systems

- Timeliness delays in update reference data when changes occur

These issues can have serious consequences, include fail trades, inaccurate risk assessments, compliance violations, and report errors. A single reference data error can propagate throughout an organization’s systems, create a cascade of problems.

Data governance challenge

Effective reference data management require robust governance:

- Ownership ambiguity unclear responsibilities for data maintenance

- Siloed management different departments maintain their own versions

- Change management coordinate update across multiple systems

- Data lineage track the sources and transformations of reference data

Technology and integration issues

The technical aspects of reference data management present their own challenges:

- Legacy systems older platforms with limited data management capabilities

- Multiple formats different systems require various data formats

- Integration complexity connect diverse applications to a central reference data source

- Scalability manage grow volumes of reference data

Best practices for reference data management

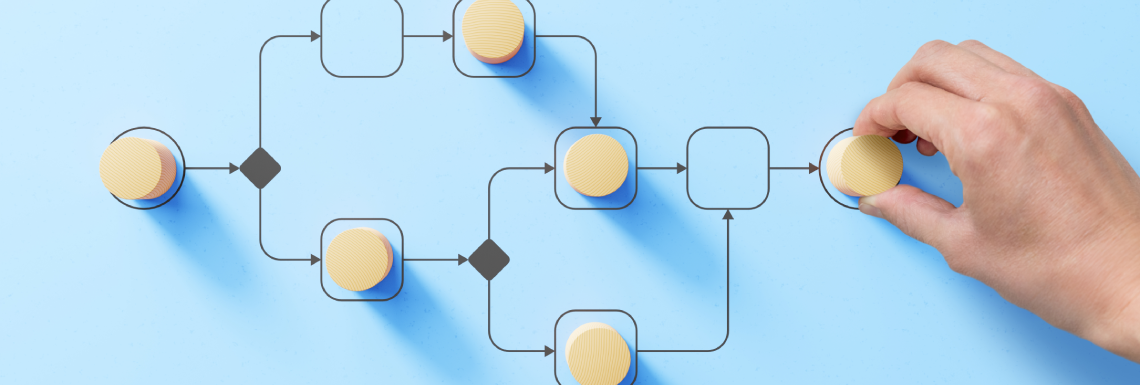

Centralized master data management (mMDM)

A centralized approach to reference data management offer significant benefits:

- Golden source establish a single authoritative version of each data element

- Standardized processes consistent procedures for data creation, update, and retirement

- Cross-functional governance involve stakeholders from all relevant departments

- Automated distribution push updates to consume systems in real time

Data quality framework

Maintain high quality reference data require a systematic approach:

- Data profiling regularly analyze reference data to identify quality issues

- Quality metrics establish kKPIsto measure completeness, accuracy, and timeliness

- Validation rules implement automated checks to prevent errors

- Reconciliation process compare data across systems to identify discrepancies

Vendor data management

Most financial institutions source reference data from external providers:

- Vendor assessment evaluate data providers base on quality, coverage, and reliability

- Service level agreements establish clear expectations for data quality and timeliness

- Vendor data integration expeditiously incorporate external data into internal systems

- Multivendor strategy use multiple sources to ensure comprehensive coverage

Technology solutions

Modern technology can importantly improve reference data management:

- Dedicated MDM platforms specialized software for manage reference data

- API base architecture enable real time access to reference data across systems

- Data virtualization create a unified view of reference data without physical consolidation

- Blockchain solutions emerge technologies for distribute reference data management

The future of reference data in finance

Industry utilities and standardization

The financial industry is move toward greater collaboration on reference data:

- Industry utilities shared platforms like dDCCs global markets entity identifier utility

- Standard identifiers wider adoption of leis and other global standards

- Open standards common data models and exchange formats

- Regulatory push authorities encourage standardization for systemic risk monitor

Advanced technologies

Emerge technologies are transformed reference data management:

- Ai and machine learning automate data quality improvement and entity matching

- Natural language processing extract reference data from unstructured sources

- Distribute ledger technology blockchain base reference data sharing

- Cloud base solutions scalable platforms for reference data management

Expand scope

The definition of reference data continue to evolve:

- ESG data environmental, social, and governance attribute become standard reference data

- Alternative data nnon-traditionalinformation sources enrich traditional reference data

- Digital assets new reference data requirements for cryptocurrencies and tokenized securities

- Supply chain data extended counterparty information cover entire supply networks

Conclusion

Reference data may not capture headlines like market movements or trading strategies, but it forms the essential foundation upon which financial operations are build. As the complexity of financial markets increases and regulatory requirements expand, the importance of high quality reference data simply grow.

Financial institutions that invest in robust reference data management gain significant competitive advantages: reduce operational risk, improve regulatory compliance, enhance decision make capabilities, and greater operational efficiency. Conversely, those that neglect reference data quality face increase challenges in an environment where data accuracy and completeness are non-negotiable requirements.

The future of reference data in finance points toward greater standardization, industry collaboration, and technological innovation. Forward think institutions are already embraced these trends, recognize that reference data excellence is not but a back office concern but a strategic imperative for success in modern financial markets.

MORE FROM nicoupon.com